What sets GCO Global 50, FI apart

GCO Global 50, FI is a mixed international investment fund that combines fixed income assets and up to 50% in national and international equities. The investment in fixed income funds will not have a specific average duration. For information or comparison purposes only, the reference rate used is a combination of the ICE BofAML 1-5 Year Euro Corporate Index (50%) and the MSCI World Total Return Euro (50%). It is a product designed for moderate investors that allows up to 50% of the savings in equities to be invested in a single fund.

Services included when you take out this global equity fund

Non-independent financial advice.

We analyse your needs and establish a financial plan designed to meet your objectives.

- Personalised service.

- Certified professionals.

- At no additional cost.

Practical information GCO Global 50, FI

- Extraordinary subscription and contributions without establishing a minimum amount.

- No penalty for total or partial reimbursements and immediate liquidity.

- No tax penalty for transfers between funds of the same company or another company, complying with the requirements of the current regulations.

This CII applies Socially Responsible Investment (SRI) criteria, which is why its investments will be guided by sustainable and financial principles.

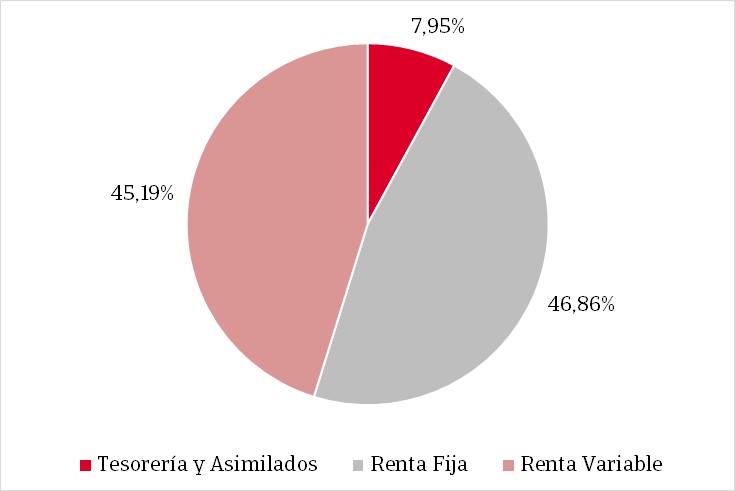

The fund will invest up to 50% of total exposure in equities and the rest in fixed income, investing in all the global markets. The investments in fixed income assets will be from public or private issuers, mainly from OECD countries, denominated in euros (including demand deposits, time deposits, promissory notes or other similar assets). It will not have a specific average duration.

With regard to equities, distribution in terms of issuers/currencies/countries is not predetermined.

The exposure will be mainly aimed at issuers of high and/or medium market capitalization, from OECD countries or other emerging countries (max. The possibility of investing in low capitalisation assets can negatively influence the liquidity of the fund. Up to 30% may be invested in foreign currency. The fund can invest up to 30% in CIIs (including those of the group, ETF, SICAV or similar assets).

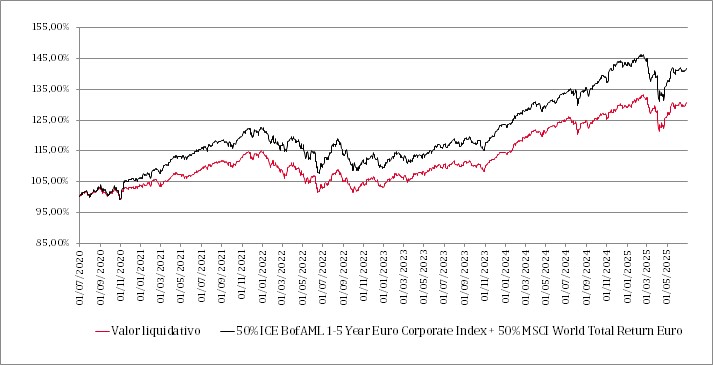

Return GCO Global 50, FI

As it is a mixed fund, the return will depend on the Equity and Fixed Income. The fund aims to provide participants with a share of the revaluation of the global stock exchanges (50%) and a part of the return of the National or International Fixed Income (50%). It should also be noted that no guarantee of return has been granted to the fund, i.e. "past returns do not guarantee future returns."

Fund performance

| Individual return (% not annualised) | Returns |

|---|---|

| Yearly total | 1.03 |

| Last quarter | 2.26 |

| Q1 | -1.2 |

| Q2 | 2.88 |

| Q3 | 0.68 |

| 2024 | 12.78 |

| 2023 | |

| 2022 | |

Fund composition

Investor profile

Sustainability information

This investment fund promotes environmental or social characteristics and although it does not aim to invest sustainably, it will have at least 50% of sustainable investments with an environmental or social objective.

Who is it designed for?

It is intended for retail investors with the capacity to take losses in relation to the level of risk of the fund and taking into account the investment time horizon indicated for the fund.

Fund volatility

The Sharpe ratio is applied to show how far the return of an investment compensates the investor for the risk assumed. It relates the return of an asset to the volatility of the price of this asset. A high Sharpe entails a better performance/volatility ratio, and conversely.