What makes our Occident Bolsa Mundial, FI different

Occident Bolsa Mundial, FI is an international equity investment fund designed to track the performance of international stock markets. CO Bolsa Mundial, FI invests in different parts of the world using the MSCI All Countries World Index Net Total Return*, it is denominated in euros, and settles purchases in the respective local currencies. This means that the fund's performance is determined both by the evolution of the parity of the currencies against the euro and by the evolution of the markets themselves.

* The MSCI All Countries World Net Total Return index (in €), an index put together by Morgan Stanley, comprises the largest capitalised companies in the markets: North American: 43%, European: 24%, Asian: 11% and Emerging: 22%. (guideline percentages at 30/09/2022).

Services included in our fund Occident Bolsa Mundial, FI

Non-independent financial advice.

We analyse your needs and establish a financial plan designed to meet your objectives.

- Personalised service.

- Certified professionals.

- At no additional cost.

Practical information Occident Bolsa Mundial, FI

- Subscription from €600.

- Extraordinary contributions from €300.

- Distribution of income, where the participant chooses the payment and the period.

- No penalty for total or partial reimbursements and immediate liquidity.

- No tax penalty for transfers between funds of the same company or another company.

How? By receiving a regular income from your investment fund, free of charges and fees, for the term you choose.

When? At the chosen frequency, monthly, quarterly, half-yearly or yearly, with a minimum amount of 100 euros per payment, with total flexibility to modify, suspend or arrange it.

Why? Complement your income, make your savings profitable and take advantage of the best tax conditions.

Who? Participants in our investment funds.

The goal is to operate the investment fund based on the current market situation, maintaining the investment and taking advantage of the opportunities that arise.

And with the best tax treatment: you are taxed only on the capital gains part of the income and not on the entire amount received (Act 35/2006).

This CII applies Socially Responsible Investment (SRI) criteria, which is why its investments will be guided by sustainable and financial principles.

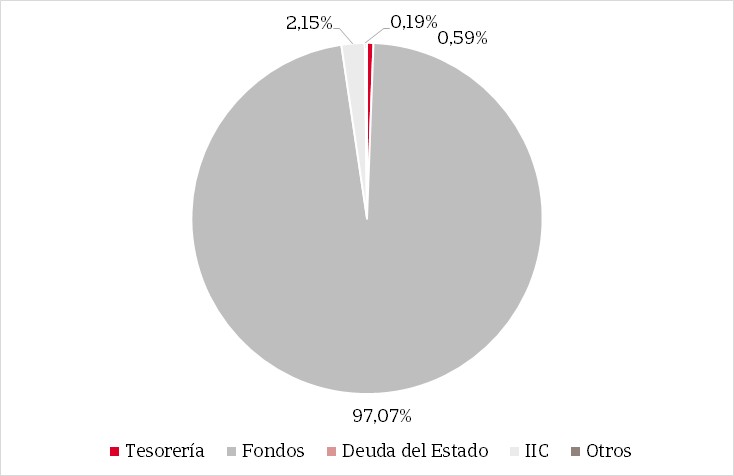

The fund's exposure to Equity will usually be around 95%, and investment will be primarily in high-capitalisation companies.

Fixed-income issues will be from public or private issuers, with the following ratings: a maximum of 25% of the issues will be of average credit quality (between BBB- and BBB +). The rest will be of high credit quality (A- or higher). However, the fund may invest in assets with a credit rating at least the same as that of the Kingdom of Spain at any given time.

Currency risk exposure will be higher than 30%, although it will usually be around 85%.

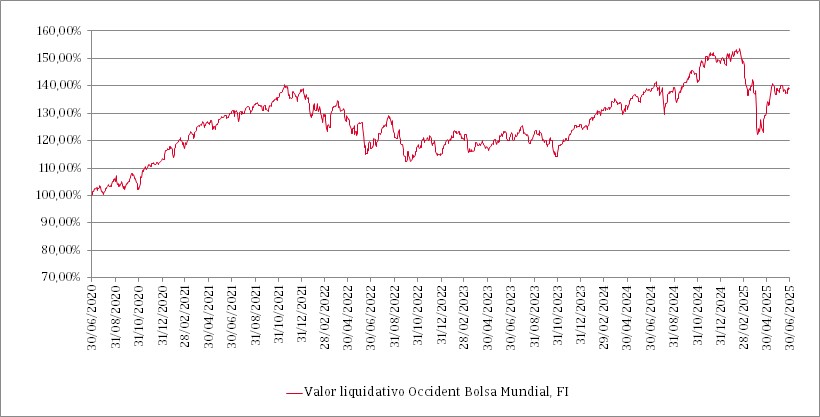

Occident Bolsa Mundial, FI, performance

The management objective is to maximise the return/risk ratio. The fund is active and management is not based on any reference rate. Past returns do not guarantee future returns.

Fund performance

| Individual return (% not annualised) | Returns |

|---|---|

| Yearly total | -6.64 |

| Last quarter | 1.67 |

| Q1 | -8.17 |

| Q2 | 5.39 |

| Q3 | 1.92 |

| 2024 | 18.4 |

| 2023 | 9.58 |

| 2022 | -16.9 |

| 2020 | 5.3 |

Fund composition

Investor profile

Sustainability information

This investment fund promotes environmental or social characteristics and although it does not aim to invest sustainably, it will have at least 50% of sustainable investments with an environmental or social objective.

Who is it designed for?

This fund is intended for investors seeking to diversify risk through positions in global equity markets.

Volatility

The Sharpe ratio is used to demonstrate how the return on an investment offsets —or does not offset— the assumption of risk. It relates the return on an asset to the volatility to which the price of that asset is subject. A high Sharpe ratio means a better return/volatility ratio and vice versa.