What makes Occident Renta Fija, FI different

Occident Renta Fija, FI is a fixed-income investment fund whose aim is to obtain returns that are in line with the interest rates of the Euro Zone. This fund invests in national and international fixed-income securities, denominated in euros, with maturities of more than one year. This fund is the best alternative for achieving a return on savings without incurring market or foreign exchange risks.

Services included in our fund Occident Renta Fija, FI

Non-independent financial advice.

We analyse your needs and establish a financial plan designed to meet your objectives.

- Personalised service.

- Certified professionals.

- At no additional cost.

Practical information Occident Renta Fija, FI

- Subscription from €600.

- Extraordinary contributions from €300.

- Contributions planned from €1,200/year, choosing the frequency of payment.

- Distribution of income, where the participant chooses the payment and the period.

- No penalty for total or partial reimbursements and immediate liquidity.

- No tax penalty on transfers between funds of the same or another company, complying with the requirements of current regulations.

How? You will receive a regular income from your investment fund without expenses or fees, for the term you choose.

When? Monthly, quarterly, half-yearly or annually, with a minimum amount of 100 euros per collection, with total flexibility to modify, suspend or take it out again.

Why? Complement your income, make your savings profitable and take advantage of the best tax conditions.

Who? All the participants in the investment fund.

This operation prevents entries and exits from the investment fund at the worst moments of the markets, mitigating volatility and always seeking to maintain the investment and obtaining a return on the opportunities offered at any given moment.

And all this with the best tax treatment, since in all cases tax is only paid on the part of the income gains that are paid and not on the entire amount received according to the current regulations.

Formula that allows planning a systematic savings plan to establish the amount and frequency.

How? By making regular contributions to the investment fund without expenses or fees, for the term you choose.

When? Monthly, quarterly, half-yearly or annually, with a minimum amount of 1,200 euros per collection, with total flexibility to modify, suspend or take it out again.

Why? To plan your savings, make a return on them and benefit from improved taxation.

Who? All the participants in the investment fund.

This operation prevents entries and exits from the investment fund at the worst moments of the markets, mitigating volatility and always seeking to maintain the investment and obtaining a return on the opportunities offered at any given moment.

This CII applies Socially Responsible Investment (SRI) criteria, which is why its investments will be guided by sustainable and financial principles.

The fund invests in national or international fixed-income securities from public or private issuers from the OECD, denominated mainly in euros.

The minimum fixed-income rating will correspond to the investment grade category (from BBB-) according to the average of S&P or the equivalent of other rating agencies. However, the fund may invest in assets with a credit rating at least the same as that of the Kingdom of Spain at any given time.

The average duration of the fixed-income portfolio will be at least two years.

Exposure to currency risk will not be any greater than 10%.

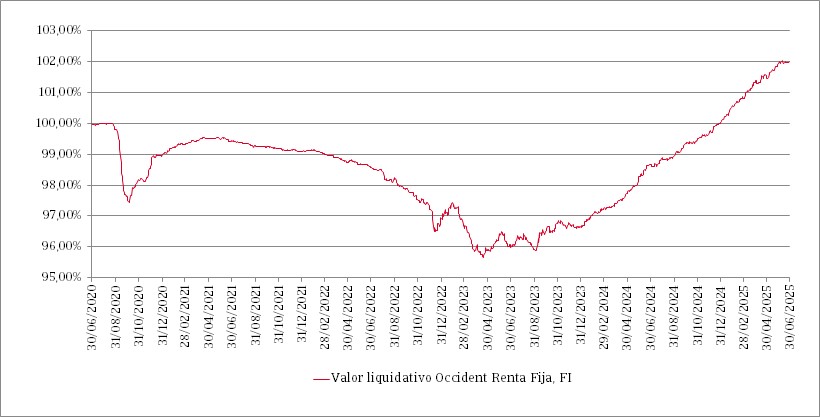

Occident Renta Fija, FI performance

The management objective is to maximise the return/risk ratio. The fund is active and management is not based on any reference rate. Past returns do not guarantee future returns.

Fund performance

| Individual return (% not annualised) | Returns |

|---|---|

| Yearly total | 1.3 |

| Last quarter | 0.81 |

| Q1 | 0.49 |

| Q2 | 0.69 |

| Q3 | 1.33 |

| 2024 | 3.4 |

| 2023 | 2.81 |

| 2022 | -2.62 |

| 2020 | -0.58 |

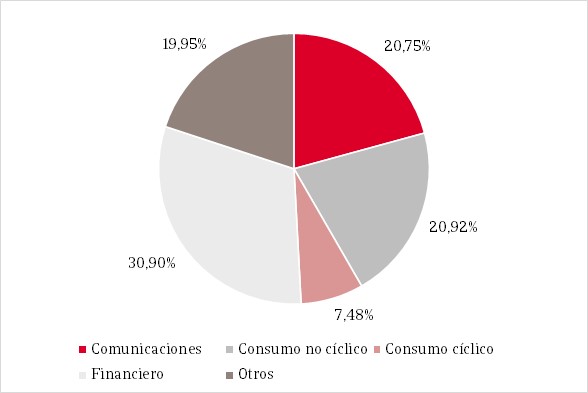

Fund composition

Investor profile

Sustainability information

This investment fund promotes environmental or social characteristics and although it does not aim to invest sustainably, it will have at least 50% of sustainable investments with an environmental or social objective.

Who is it designed for?

It is intended for retail investors with the capacity to take losses in relation to the level of risk of the fund and taking into account the investment time horizon indicated for the fund.