What makes GCO Acciones, FI different

GCO Acciones, FI is a Euro equity fund. The Fund invests 100% of its portfolio in national equities. This fund is aimed at customers who want to invest in the Spanish stock exchange.

Services included in our GCO Acciones, FI fund

Non-independent financial advice.

We analyse your needs and establish a financial plan designed to meet your objectives.

- Personalised service.

- Certified professionals.

- At no additional cost.

Practical information GCO Acciones, FI

- Extraordinary subscription and contributions without establishing a minimum amount.

- No penalty for total or partial reimbursements and immediate liquidity.

- No tax penalty for transfers between funds of the same company or another company, complying with the requirements of the current regulations.

This CII applies Socially Responsible Investment (SRI) criteria, which is why its investments will be guided by sustainable and financial principles.

The Fund will have at least 75% of the portfolio in equity assets listed in Spanish markets, including assets from Spanish issuers quoted in other markets, and will be mainly aimed at issuers of high and/or medium market capitalization. The national equities must comprise at least 90% of the equity portfolio. Up to 30% may be invested in foreign currency.

The fund can invest up to 30% in CIIs (including those of the group, ETF, SICAV or similar assets).

Return GCO Acciones, FI

Historically, equities have always provided returns that exceed other long-term financial assets. The fund aims to provide participants with the revaluation of the Ibex 35 Net Return. Important: There is no guarantee of returns. "Previous returns do not guarantee future returns."

Fund performance

| Individual return (% not annualised) | Returns |

|---|---|

| Yearly total | 20.59 |

| Last quarter | 7.69 |

| Q1 | 11.97 |

| Q2 | -1.22 |

| Q3 | 7.09 |

| 2024 | 16.77 |

| 2023 | |

| 2022 | |

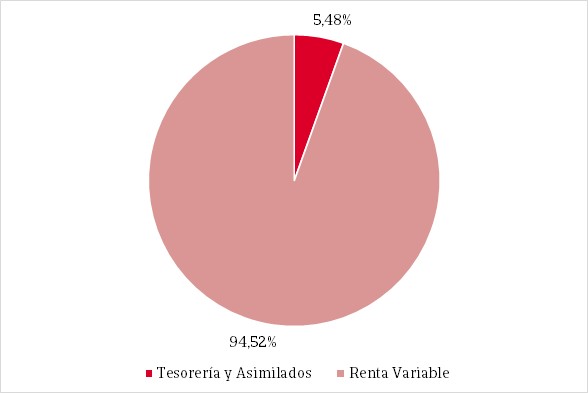

Fund composition

Investor profile

Sustainability information

This investment fund promotes environmental or social characteristics and although it does not aim to invest sustainably, it will have at least 50% of sustainable investments with an environmental or social objective.

Who is it designed for?

It is intended for retail investors with the capacity to take losses in relation to the level of risk of the fund and taking into account the investment time horizon indicated for the fund.

Fund volatility

Index applied: SHARPE. The Sharpe ratio is used to show how far the return of an investment compensates the investor for assuming risk. It relates the yield of an asset to the volatility of the price of this asset. The greater the Sharpe ratio, the better the performance/volatility ratio.